Key Facts

- ✓ Legacy semiconductor companies experienced a wave of leadership changes, with new executives often drawn from the artificial intelligence and advanced manufacturing sectors.

- ✓ US export policy on advanced chips was characterized by inconsistency, creating significant uncertainty for manufacturers and their international partners.

- ✓ The market was heavily influenced by geopolitical tensions, with international forums like the United Nations serving as key discussion points for technology trade.

- ✓ Companies responded to market pressures by increasing investment in domestic production and diversifying their supply chains to mitigate risks.

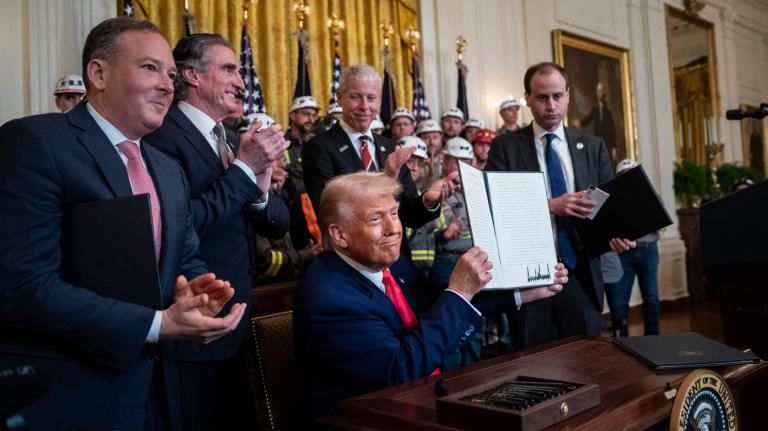

- ✓ Strategic partnerships between private firms and government entities became more common, aimed at bolstering national research and manufacturing capacity.

A Year of Transformation

The US semiconductor market experienced a period of profound change throughout 2025, characterized by significant leadership transitions at established companies and a fluctuating policy landscape regarding chip exports. These developments unfolded against a backdrop of intense global competition and strategic realignment within the critical technology sector.

From the boardrooms of legacy manufacturers to the halls of government, decisions made during this year carried substantial weight for the future of domestic production and international technological leadership. The industry's trajectory was shaped by both internal corporate evolution and external geopolitical pressures.

Leadership Shifts at Legacy Firms

Several prominent semiconductor companies saw major changes in their executive leadership, signaling a potential new direction for the industry's established players. These transitions often involved the appointment of new CEOs or board members with backgrounds in artificial intelligence, advanced manufacturing, and strategic partnerships, reflecting the evolving priorities of the sector.

The reshuffling of leadership at these legacy firms was not merely a routine corporate event. It represented a strategic pivot aimed at addressing emerging market demands and navigating an increasingly complex global supply chain. New leaders were tasked with balancing long-term R&D investments against the immediate pressures of market competition and shareholder expectations.

- Appointment of new CEOs with tech-forward backgrounds

- Boardroom restructuring to prioritize innovation

- Strategic hires from adjacent high-growth industries

- Focus on next-generation chip architectures

The Export Policy Puzzle

US policy regarding the export of advanced semiconductors proved to be a central and contentious issue throughout the year. The approach was frequently described as wishy-washy by industry analysts, with regulations and restrictions subject to change and interpretation. This created an environment of uncertainty for both domestic manufacturers and international partners.

The inconsistent policy framework impacted trade relationships and complicated long-term planning for companies operating in the sector. Decisions regarding which chips could be sold to which countries were made with significant geopolitical considerations, often leaving businesses to navigate a shifting regulatory landscape with limited clarity on future rules.

The lack of a clear, consistent policy on chip exports created significant challenges for long-term strategic planning across the industry.

Geopolitical and Market Forces

The dynamics of the US semiconductor market in 2025 were inextricably linked to broader geopolitical tensions. Competition with other nations for technological supremacy intensified, influencing both corporate strategies and government policies. The United Nations and other international bodies were often the venues for discussions on trade standards and technology access.

Market forces were equally dynamic, with demand for chips in sectors like automotive, consumer electronics, and data centers continuing to grow. However, supply chain disruptions and the strategic stockpiling of components by various nations added layers of complexity to the market. Companies were forced to adapt to these pressures, leading to increased investment in domestic production capabilities and diversification of supply sources.

- Intensified global competition for chip dominance

- Increased strategic stockpiling by nations

- Investment in domestic manufacturing facilities

- Supply chain diversification efforts

Strategic Realignment

In response to these challenges, many companies undertook significant strategic realignments. This involved not just changes in leadership and policy adaptation, but also a re-evaluation of core business models and partnerships. Some legacy firms began to shed non-core assets to focus on their most advanced semiconductor technologies.

Collaborations between private companies and government entities also became more prominent, aimed at bolstering domestic research and manufacturing capacity. These partnerships were designed to ensure the United States maintained a competitive edge in the development of next-generation chips, which are critical for future technologies like quantum computing and autonomous systems.

Looking Ahead

The events of 2025 have set a new course for the US semiconductor industry. The leadership changes and policy shifts experienced during the year have created a foundation for what may be a period of accelerated innovation and strategic focus. The industry's ability to adapt to these changes will be crucial for its long-term health and global standing.

As the new year begins, the focus will likely remain on strengthening domestic capabilities while navigating the intricate web of international trade and competition. The decisions made in 2025 will continue to influence the market's direction, with the legacy of that year's transformations shaping the technological landscape for years to come.