Key Facts

- ✓ Crypto experts say political pressure on the US Federal Reserve could drive volatility

- ✓ Political pressure could shift flows toward Bitcoin and gold in the long run

Quick Summary

Crypto experts are warning that political pressure on the US Federal Reserve could create significant market volatility while potentially driving long-term investment flows toward Bitcoin and gold.

The analysis suggests that any perceived interference in central bank independence may undermine confidence in traditional monetary policy tools, leading investors to seek alternative assets.

Market participants are particularly concerned about how political influence might affect interest rate decisions and inflation targets.

The potential shift toward cryptocurrencies and precious metals represents a broader trend of diversification away from fiat currencies.

Financial analysts note that this could accelerate institutional adoption of digital assets as a hedge against policy uncertainty.

Market Volatility Concerns

Crypto experts have identified political pressure on the US Federal Reserve as a primary driver of potential market instability. The concern centers on how external influence might compromise the central bank's ability to make data-driven decisions.

When monetary policy appears subject to political whims, markets typically react with increased volatility. This uncertainty can manifest in several ways:

- Rapid price swings in currency markets

- Increased trading volumes in alternative assets

- Heightened sensitivity to policy announcements

The US Federal Reserve has traditionally operated with a degree of independence designed to insulate economic decisions from short-term political considerations.

Experts suggest that any erosion of this independence could force investors to recalibrate their risk assessments across multiple asset classes.

Long-term Flow Shifts

While short-term volatility remains a concern, experts predict more profound long-term shifts in how capital is allocated across global markets. The analysis indicates that sustained political pressure could fundamentally alter investment strategies.

Bitcoin and gold are emerging as the primary beneficiaries of this potential shift. Both assets share characteristics that appeal to investors seeking protection from institutional uncertainty:

- Limited supply mechanisms

- Decentralized or independent valuation

- Historical performance during currency debasement

The Bitcoin market has matured significantly, with institutional infrastructure now supporting large-scale capital flows.

Similarly, gold maintains its status as the traditional safe-haven asset during periods of monetary policy uncertainty.

These alternative assets may see increased allocation as portfolio diversification strategies evolve.

Global Central Bank Response

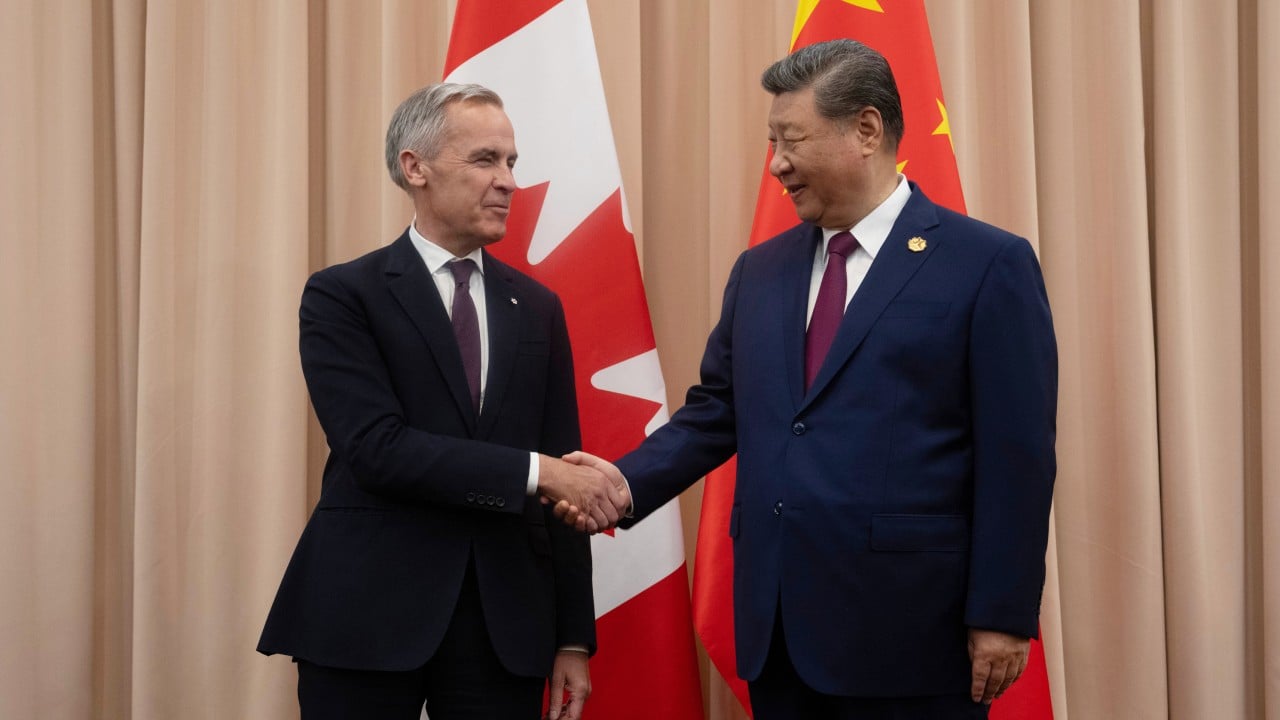

World central banks have rallied behind Powell and emphasized the critical importance of Fed independence. This unified stance reflects broader concerns about the stability of the global financial system.

The international banking community views central bank autonomy as essential for:

- Maintaining credible inflation targets

- Ensuring currency stability

- Supporting international trade and investment

When major central banks coordinate their messaging, it signals a collective commitment to preserving institutional integrity.

The US Federal Reserve plays a particularly important role in the global financial architecture, with its policies affecting markets worldwide.

International observers note that any compromise to Fed independence could have ripple effects across emerging and developed economies alike.

Investment Implications

The intersection of political pressure and monetary policy creates a complex environment for investors navigating both traditional and digital asset markets.

Portfolio managers are increasingly considering:

- Alternative stores of value beyond fiat currencies

- Geographic diversification of central bank exposure

- Dynamic hedging strategies using multiple asset classes

The cryptocurrency sector stands at a unique crossroads where institutional uncertainty could accelerate mainstream adoption.

Market infrastructure has developed to the point where large institutional flows can move into digital assets with relative ease.

This accessibility, combined with the narrative of decentralized monetary systems, positions cryptocurrencies as a potential hedge against traditional policy risks.

However, experts caution that all investments carry risks, and the relationship between political pressure and asset performance remains complex and evolving.